Your Roof Protects Your Largest Capital Investment.

RCV vs ACV Policies

What is Replacement Cost Value? (RCV)

A REPLACEMENT COST VALUE policy is designed to repair damage done to your home, less your Deductible.

What is Actual Cash Value? (ACV)

An ACTUAL CASH VALUE policy is designed to repair the damage done to your home, less your Deductible and less Depreciation.

An example will best illustrate the difference. The Smiths and the Johnsons are next door neighbors. Their homes are the same size, built in the same year, and have the exact same floorplan. Neither family has had the roof replaced. The Smiths have a Replacement Cost Value policy (RCV), while the Johnsons have an Actual Cash Value policy (ACV). One night a terrible storm tears through their town, destroying the Smith’s and the Johnson’s roof. Both the Smiths and the Johnsons have a $1,000 Deductible, and both roofs incurred $10,000 of damage.

Replacement Cash Value Claim Settlement

To replace the entire roof, the Smiths are only responsible for their Deductible of $1,000. With Replacement Cost (RCV), the insurance company will pay the full cost of replacing the roof (they provide the estimate) minus the Deductible. Thus, the Smith’s homeowner’s insurance policy will cover $9,000 for replacement, $10,000 cost minus the $1,000 Deductible which the Smiths will pay.

Actual Cash Value Claim Settlement

The Johnsons, on the other hand, are not quite as lucky. The roof on their home is 19 years old. But now, due to weather and age, it is only worth about $6,000. In other words, it has Depreciated by $4,000. The Johnson’s insurance policy will cover the damage to their roof, less their Deductible and less Depreciation. The Johnsons

need to pay $5,000 to replace their roof, the insurance company will only provide $5,000 of the cost to the Johnsons. Thus, the insurance company starts with the $10,000 replacement cost (they provide the estimate) minus the $1,000 Deductible and the $4,000 of Depreciation, paying only $5,000, leaving the remaining $5,000 to be paid by the Johnsons.

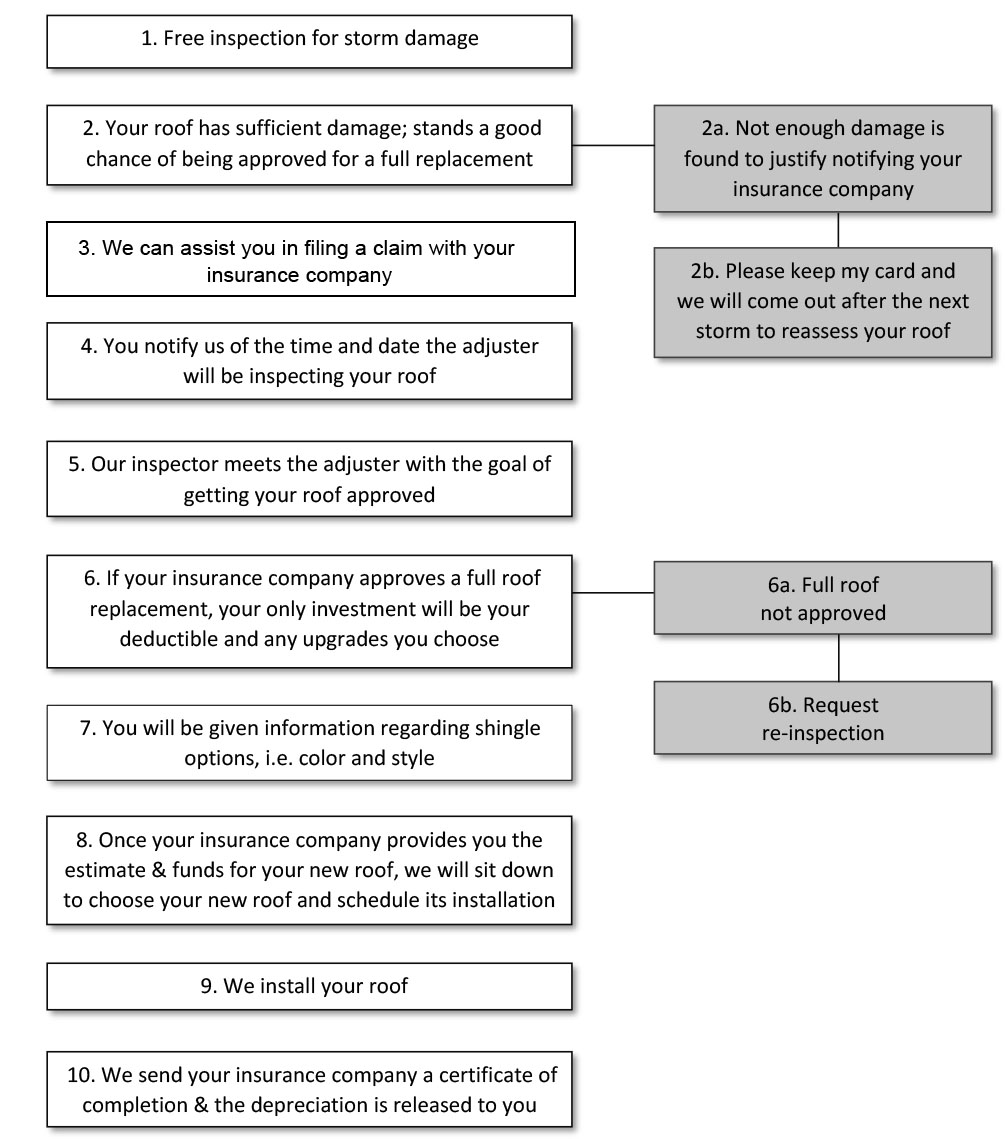

I hope this helps you better understand the difference between an RCV and ACV policy. Please let me know if you have any other questions or if you would like to proceed with the Free Storm Damage Inspection.

THE DEDUCTIBLE

Deductibles have been an essential part of the insurance contract for many years and represent a sharing of the risk between the insurance company and the policyholder.

A deductible can be either a specific dollar amount or a percentage, as stated on the policy. The amount is established by the terms of coverage and can be found on the declarations (or front) page of standard homeowner’s insurance policies.

A deductible is an amount of money that the homeowner is responsible for paying toward an insured loss. The amount of the deductible is subtracted, or “deducted,” from the claim payment.

Here is how it works: If the policyholder has a $1,000 deductible, the $1,000 will be deducted from the claim payment.

For example, if the insurance company determines that the total replacement cost value (RCV) of the roof is $10,000, the policyholder will pay $1,000 out of pocket and receive a check for the remaining $9,000.

Often the Homeowner mistakenly thinks that the insurance company has paid the deductible because they see it has been subtracted from the total amount of the RCV.

In the state of Louisiana, it is Insurance Fraud to waive the deductible.